llc s corp tax calculator

We Make It Easy With Step-By-Step Guidance. But as an S corporation you would only owe self-employment tax on the 60000 in.

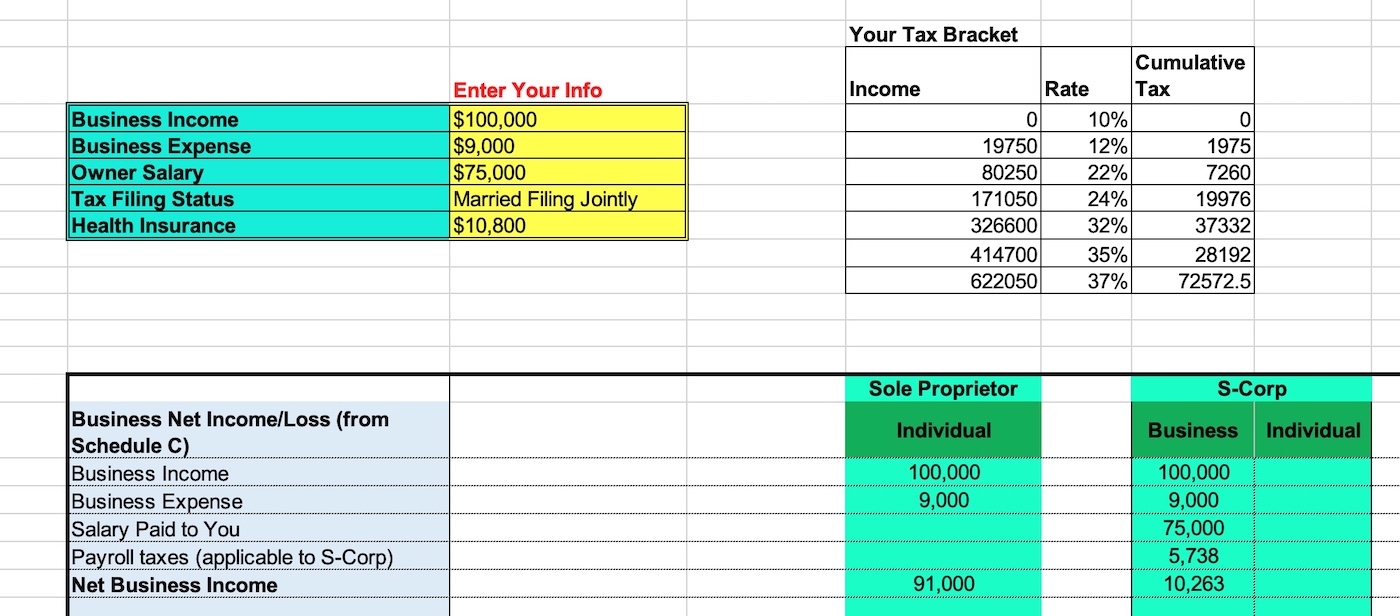

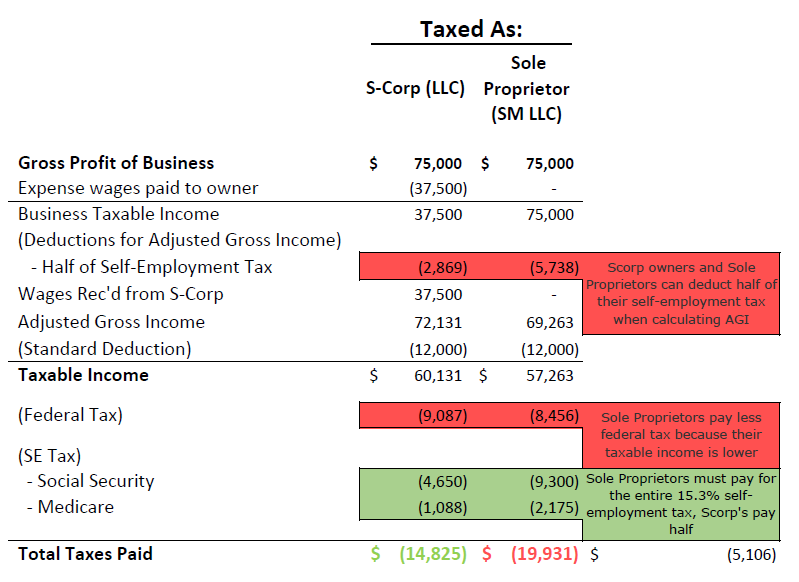

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S.

. The conversion to a LLC. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. It lets you write off your salary.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. The S Corp Tax Calculator. This calculator helps you estimate your potential savings.

Therefore 39 of 200000 is equal to 78000. S-Corp Reasonable Compensation ins and outs. Youre guaranteed only one deduction here effectively.

We have ignored the Employment Allowance which refunds Employers NICs up to 5000 each calendar. One of the top questions that clients ask is for real life example of how switching to a C Corp S corporation or LLC could benefit them from a tax perspective. The biggest concern is the tax consequences.

Premium federal filing is 100 free with no upgrades for premium taxes. Annual cost of administering a payroll. The tax on this is equal to 22000 and youll need to add 39 on any amount above 100000.

We are not the biggest. Obviously there are many. This allows owners to pay less in self-employment.

The S Corporation tax calculator lets you choose how much to withdraw from your business each year and how much of it you will take as salary. To get the total tax amount. Additional Self-Employment Tax Federal Level 153 on all business income.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. Total revenue is calculated by subtracting. This allows owners to pay less in self-employment taxes and.

AS a sole proprietor Self Employment Taxes paid as a Sole. Ad Free tax filing for simple and complex returns. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

From the authors of Limited Liability Companies for Dummies. Our small business tax calculator has a. Enter your estimated annual business net income and the reasonable salary you will pay.

This application calculates the. S-Corporations Determine Reporting Requirements of Certain S-Corp Expenses Assess the Implications of Fringe. S Corporation Expenses Line 12.

S Corp vs LLC Tax Savings Calculator Electing S corp status allows LLC owners to be taxed as employees of the business. Find out why you should get connected with a CPA to file your taxes. Annual state LLC S-Corp registration fees.

In the District of Columbia a S corporation may convert to a LLC by approving a plan of conversion. Guaranteed maximum tax refund. LLC S-Corp C-Corp - you name it well calculate it Services.

There is a big. This allows owners to pay less in self-employment taxes and contribute pre-tax. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a.

Corporation Tax has been applied at the prevailing rate of 19 2022-23 tax year. 2 ways starting an S corp can help you save money on taxes Related Dividends For S Corp and C Corp Owners Explained Finances and Taxes 1. Easy And Affordable To Create.

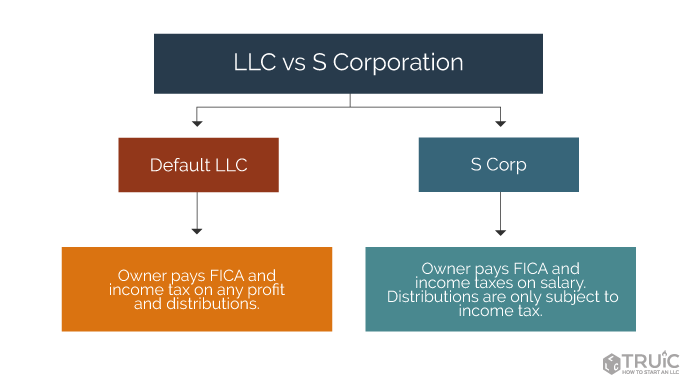

Tax and Licenses Taxes not. S Corp vs LLC Tax Savings Calculator Electing S corp status allows LLC owners to be taxed as employees of the business. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

765 765 153 Employees Tax Burden Employers Tax Burden VIEW CALCULATOR Being Taxed as an S-Corp Versus LLC If your business has net income of 70000 and youre taxed. Estimated Local Business tax. There is a lot of misconception on how to pay yourself that Reasonable Compensation when your company is an S-Corp.

As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Total first year cost of S-Corp. Ad Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets.

Forming an S-corporation can help save taxes. Federal Income Tax and Employment Tax for LLCs and S Corporations Federal income tax applies to an individuals total revenue. Electing S corp status allows LLC owners to be taxed as employees of the business.

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

Delaware Franchise Tax How To Calculate And Pay Bench Accounting

Llc Tax Calculator Definitive Small Business Tax Estimator

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

How Accurate Are Online Tax Calculators Incompass Tax Estate And Business Solutions Sacramento

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

S Corp Vs Llc Difference Between Llc And S Corp Truic

S Corp Income Tax Rate What Is The S Corp Tax Rate

Filing A Schedule C For An Llc H R Block

Free Llc Tax Calculator How To File Llc Taxes Embroker

How To Convert To An S Corp 4 Easy Steps Taxhub

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Llc And S Corporation Income Tax Example Tax Hack

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax